Patanjali Foods Shares Fall 5% Due To Supreme Court Notice On Misleading Ads By Promoter

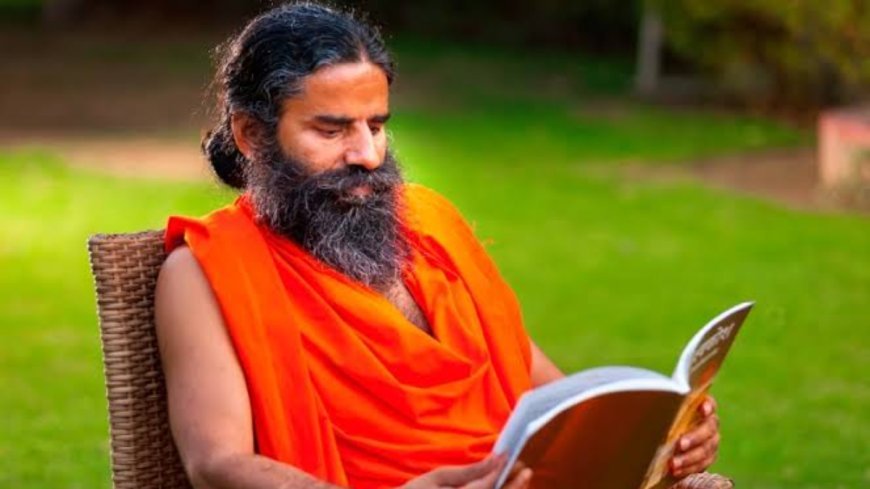

The Supreme Court's decision stemmed from Patanjali Ayurved's persistent dissemination of false and deceptive claims regarding the efficacy of its products in curing diseases.

The Supreme Court's contempt notice to Patanjali Ayurved and its MD, Acharya Balakrishna, for violating previous orders by disseminating misleading advertisements has significantly impacted Patanjali Foods' stock performance. Shares plunged 5% to Rs 1,536 in intra-day trading on Wednesday, following the court's stern action against the promoter firm.

By 1:50 pm, the stock had dropped 4% to Rs 1,558. Trading activity indicated heightened investor concern, with approximately 46,000 shares traded compared to the two-week average volume of around 32,000 shares on the BSE. Concurrently, the S&P BSE Sensex experienced a decline of 0.7% (500 points), standing at 72,575.

The Supreme Court's decision stemmed from Patanjali Ayurved's persistent dissemination of false and deceptive claims regarding the efficacy of its products in curing diseases. Consequently, the apex court imposed a ban on Patanjali advertisements, admonishing the Central government for its perceived inaction in addressing the matter. The court's rebuke underscored the gravity of the situation, criticizing Patanjali Ayurved's unsubstantiated assertions of providing permanent relief.

This development marks a continuation of the legal battle initiated against Patanjali Ayurved, as the company had previously assured the court in November 2023 that it would refrain from making such claims in future advertisements. Despite these assurances, the company's actions have prompted renewed scrutiny and condemnation from the judiciary.

Patanjali Ayurved holds a substantial 32% stake in Patanjali Foods, with the broader Patanjali Group commanding a 74% stake in the food company. The implications of the Supreme Court's actions extend beyond the immediate legal repercussions, casting a shadow over the corporate governance practices within the conglomerate.

Financially, Patanjali Foods experienced a 19.5% decline in net profit for the quarter ending December 2023, amounting to Rs 216.54 crore compared to Rs 269.19 crore in the corresponding period the previous year. Total income also witnessed a marginal downturn, standing at Rs 7,957 crore.

Also Read: Skoda Enyaq EV Review: Price, Specifications, Features & More

The court's reprimand not only underscores the gravity of the allegations against Patanjali Ayurved but also raises questions about the company's commitment to ethical advertising practices and compliance with regulatory mandates. Furthermore, the fallout from this legal saga could potentially tarnish the reputation of the broader Patanjali Group, affecting investor sentiment and market perception.

As legal proceedings unfold, stakeholders will closely monitor developments, particularly regarding Patanjali Ayurved's response to the contempt notice and efforts to rectify the issues raised by the court. The outcome of these deliberations will have far-reaching implications for the company's future operations, corporate governance framework, and standing within the Indian business landscape.